You spend hours flipping through pages, highlighting numbers, and then entering them manually into Excel. It’s slow, prone to errors, and honestly—it’s 2025, we shouldn’t still be doing this.

The good news? Things have changed. Big time.

Thanks to tools like OCR bank statement processors and AI-powered platforms, we’re seeing a digital revolution in how financial documents are handled. And if your business hasn’t jumped on board yet, now’s the perfect time to explore why you should.

Why Going Digital Isn’t Just a Trend

Digitizing financial documents isn’t about being flashy with new tech. It’s about saving time, cutting down on errors, and making life easier for you and your team.

Here’s what going digital offers:

-

✅ Faster data entry

-

✅ Instant access to important files

-

✅ More accurate records

-

✅ Easier sharing and collaboration

-

✅ Better compliance and audit-readiness

Whether you’re a small business owner, an accountant, or part of a large finance team, these benefits directly impact your daily workflow.

What is an OCR Bank Statement Tool?

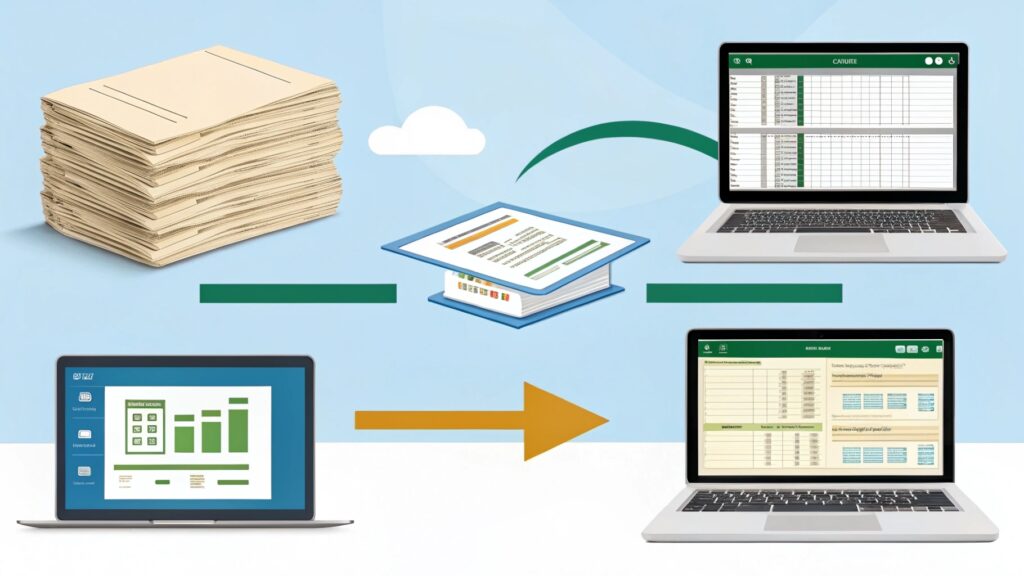

Let’s break it down. OCR stands for Optical Character Recognition . It’s a technology that reads text from images or scanned documents—like bank statements—and converts them into editable formats, such as Excel.

In simple terms? It takes your paper statement and transforms it into clean, organized spreadsheet data. You don’t have to type anything. The tool reads, extracts, and structures the data for you.

So instead of spending 2 hours manually typing in transactions, you’re done in under 5 minutes.

How OCR and AI Work Together

OCR does the reading. AI does the thinking.

AI-powered tools take OCR to the next level. They recognize patterns, understand financial formats, and even learn over time to handle different types of bank statements. With this combination, you get data that’s not just digitized—but smartly organized.

Think of it as moving from just scanning a document to fully automating your financial workflow .

Common Use Cases

You might be wondering: “Is this really something I need?” If you deal with financial documents in any of these roles, the answer is yes.

For Accountants:

Speed up reconciliation. Multiple client handles. Reduce mistakes.

For Small Business Owners:

Keep track of expenses, invoices, and cash flow without drowning in paperwork.

For Finance Teams:

Ensure timely reporting and smooth audits. Focus on strategy, not data entry.

For Lenders & Fintech Startups:

Accelerate onboarding by extracting bank data quickly and accurately.

Why Excel Still Matters

Despite all the new platforms and dashboards, Excel is still the go-to tool for many professionals. It’s flexible, powerful, and familiar.

What makes OCR bank statement tools even more valuable is their ability to export data directly into Excel , already sorted into columns like:

-

Date

-

Description

-

Credit

-

Debt

-

Balance

You open the file, and it’s ready to go. No cleanup needed.

The Hidden Costs of Staying Manual

Still using paper? Or relying on spreadsheets you update by hand? Here’s what it’s costing you:

-

Time : Manually entering data eats up hours you could spend on analysis, strategy, or growing your business.

-

Mistakes : Humans are human. One small typo can throw off your whole report.

-

Stress : Deadlines feel tighter when you’re stuck cleaning up messy paperwork.

-

Risk : Manual records are harder to track, audit, and back up.

It adds up quickly. That’s why the shift from paper to Excel—through OCR and automation—isn’t just smart. It’s necessary.

FAQs

Can OCR handle all types of bank statements?

Most modern tools support a wide range of formats, including PDFs, scanned images, and even photos. They can handle statements from various banks too.

Is it secure to use OCR for sensitive financial data?

Yes. Reputable OCR solutions use encryption and data privacy best practices to ensure your information stays safe.

Do I need technical skills to use an OCR tool?

Not at all. Most tools are designed for everyday users. If you can upload a file and download an Excel sheet, you’re good.

Can this replace an accountant?

No—but it can help your accountant do their job better . Less time spent on manual work means more time for valuable analysis.

What happens if the document is blurry or unclear?

AI-powered OCR tools are getting better at reading even imperfect documents, but it’s always best to scan or photograph statements clearly.

Conclusion

Let’s face it—managing financial documents the old-fashioned way is exhausting. The shift from paper to Excel isn’t just about convenience. It’s about unlocking more time, boosting accuracy, and reducing stress in your daily work.

With OCR bank statement tools and AI-driven platforms, you’re not just digitizing documents. You’re transforming the way you work.